Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.

John Wanamaker

late 1800s

With Covid-19 grinding several industries to a halt, FIRST Digital has taken the opportunity to work with one of our tourism clients to assess the advertising effectiveness of the media they invest in.

The adstock of each medium represents the cumulative contribution to a target or sales which captures the spillover effect and synergy among them (Danaher, 2017). This applied analytics model can help businesses understand the channel attribution across online and offline media, thereby, getting better insight into each medium’s true effects and being able to properly report on their Return On Marketing Investment (ROMI).

The adstock model has a distinct advantage over other models such as Markov or Sharpley, which are limited to the digital space. This simple regression model accounts for both online and offline channel performance that drive sales. It can also provide effective guidance on budget allocation– including where and how to invest.

Finding the adstock value

Four targets were set for the project: online sessions, online revenue, offline revenue and offline enquiries.

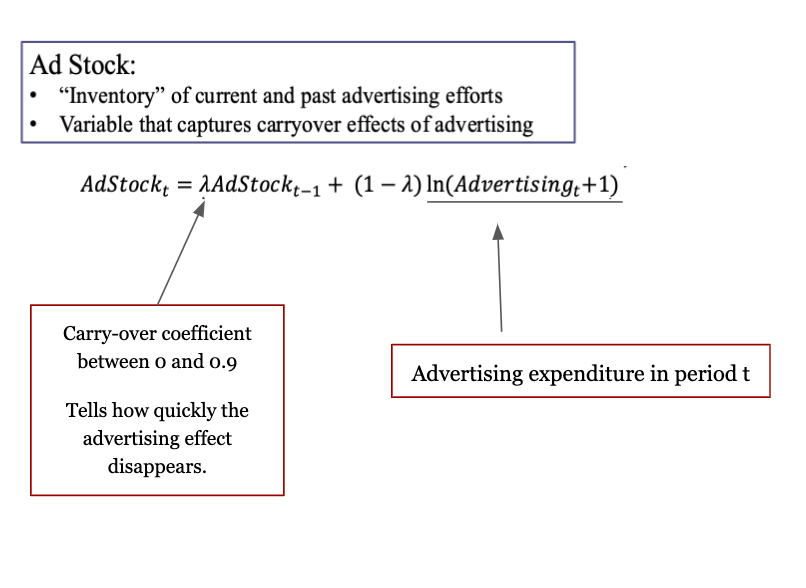

To find each medium’s adstock value, a carry over parameter lambda λ is computed for each medium. This parameter indicates how quickly the advertising effect wears out.The lambda value is between 0 and , which gives the exponential weighted average measurement accounting for both the past and current ad spend effects. Also, knowing the lambda values allows us to calculate the duration of each medium’s ad effectiveness.

We applied an algorithm to find the optimal lambda values between 0 and 1 based on the model’s goodness of fit. Then we calculated each of the seven Adstocks with its own lambda, and fit them as predictors in the model. The seven Adstocks include Paid Search, Paid Social, Television, Newspaper, Radio, E-mail, and Display.

The results of the adstock model application show that five channels contribute to at least one of the targets. These are: paid search, paid social, radio, email and newspaper ads.

Based on the lambda values, we can calculate the 90% interval duration that each medium’s spillover effect could last. Their duration values in days are demonstrated below:

One crucial data point that we learned from this modeling approach is the true display ads attribution. Display ads have long been relegated as a secondary media when considering digital investments, due to its consistently low conversion rate. Usually, the average clickthrough rate of a display ad is very low at 0.05% (Chaffey, 2019). This number is even lower for conversion rates, which is likely to make ad spend on display have little return.

Surprisingly, the report found that display ads have a spillover effect that is longer than its digital counterparts — as long as 22 days for online revenue and 6 days for offline revenue.

On the other hand, this particular client invests heavily in traditional media such as newspapers and TV. The modeling output found that TV ads are rather ineffective for sales, but have long-lasting adstock up to 22 days. Therefore, the high investment in TV yields little return. Another highly invested medium, Newspapers, is contributing strongly to offline sales only, yet the ROMI does not promise a high profit.

The adstock model allowed FIRST to make solid recommendations for optimal budget allocation proportional to the ad elasticity in driving conversions. For this particular industry, the top two channels are Paid Search and Paid Social — which contributed significantly across both online and offline sales. Between them, Paid Search had higher elasticity, thus more investment is recommended.

The proposed optimal budget is expected to increase online revenue by 6% compared to their current budget. Meanwhile, the budget also suggests ad costs can be reduced by 33% while the same level of sales can be maintained.

Similarly, if a different amount of fund is assigned for the offline platform, the optimal budget has a potential boost in offline revenue by 24%, and a possible 44% decrease in the media spend across these five channels. This optimal reallocation is likely to increase the number of offline enquiries most, with a lift of 35%, or a spend of less than half of current spend to receive the same number of enquiries. Therefore, executing the proposed optimal advertising budget can help achieve profit maximisation.

We recommend reviewing the AdStock model’s results at least once a year.The model itself is not complicated, the only challenging part is sourcing the Ad Spend data, which can be scattered between different business departments. This is however a good opportunity for various teams in the business to regroup and focus on what matters most. As always, insights are worthless if not followed by an action. So the next step is to test the Adstock model’s results by shifting advertising budgets around, measuring impact on your targets (aka KPI), and reiterating to achieve an ongoing data-driven optimisation process.

Footnotes:

Danaher, P. (2017). Advertising effectiveness and media exposure. In Wierenga, B. & van der Lans, R. (2017) Handbook of marketing decision models. International Series in Operations Research & Management Science 254. NY: Springer.

Van Heerde, Harald (2018), Block 2: Measuring Advertising Effectiveness [PowerPoint slides]. Massey University, Return on Marketing Investment. Stream.massey.ac.nz